The Importance of Forex Trading Regulations A Comprehensive Guide 1744227860

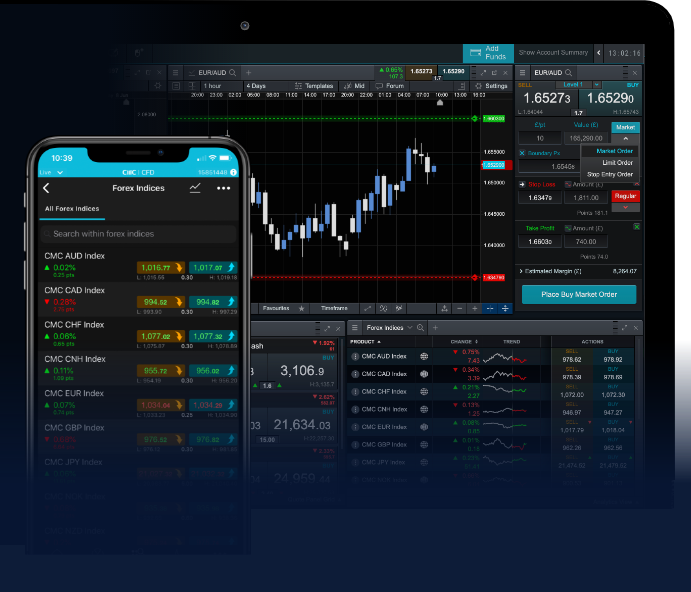

Forex trading regulations play a crucial role in ensuring a fair and transparent trading environment for participants in the global currency market. The world of forex trading can be both thrilling and challenging, especially for newcomers. To navigate this complex landscape, understanding the regulations governing forex trading is essential. In this article, we will delve into the specifics of forex trading regulations, their importance, and how they affect traders globally. For those looking to enhance their trading experience, exploring forex trading regulations Forex Trading Apps can also be beneficial.

What Are Forex Trading Regulations?

Forex trading regulations are rules and guidelines set forth by government bodies and financial authorities to oversee the forex market’s operations. These regulations aim to ensure the integrity, transparency, and security of trading practices. They can vary significantly from one jurisdiction to another, reflecting the unique economic and legal environments of each country.

Why Are Forex Regulations Important?

Forex trading regulations serve several critical purposes:

- Investor Protection: Regulations help protect traders from fraud and unethical practices. Licensed brokers are required to adhere to specific standards, which reduces the occurrence of scams.

- Market Integrity: By ensuring that all market participants play by the same rules, regulations help maintain a level playing field, which is critical for market efficiency.

- Transparency: Regulations require brokers to provide clear information about their services, fees, and risks, enabling traders to make informed decisions.

- Financial Stability: Adhering to regulations can minimize systemic risks and contribute to the overall stability of the financial system.

Key Regulatory Bodies in Forex Trading

Various regulatory bodies oversee forex trading in different regions. Some of the most prominent include:

- Commodity Futures Trading Commission (CFTC) – United States: The CFTC is responsible for regulating derivatives markets, including forex, to protect market participants from fraud and abusive practices.

- Financial Conduct Authority (FCA) – United Kingdom: The FCA oversees financial markets in the UK and ensures that brokers operate fairly and transparently.

- Australian Securities and Investments Commission (ASIC) – Australia: ASIC regulates the financial services industry, including forex brokers, to maintain fair and transparent markets.

- European Securities and Markets Authority (ESMA) – European Union: ESMA works to enhance investor protection and promote stable and orderly financial markets within the EU.

Types of Regulations

Forex trading regulations can be categorized into several types:

- Licensing Requirements: Brokers must obtain licenses from regulatory bodies to operate legally. This ensures that they meet specific standards for financial health and operational integrity.

- Capital Requirements: Regulators often impose minimum capital requirements to ensure that brokers can cover potential trading losses and protect client funds.

- Segregation of Client Funds: Many regulations require brokers to keep client funds in separate accounts, reducing the risk of loss if the broker faces financial difficulties.

- Leverage Restrictions: To protect traders from excessive risk, regulators may limit the amount of leverage that brokers can offer.

The Impact of Regulations on Traders

Forex trading regulations significantly affect traders both positively and negatively. On one hand, they provide a safer trading environment and protect investors from fraud. On the other hand, regulatory measures, such as leverage restrictions and compliance costs, can affect trading strategies and profitability.

Global Differences in Forex Trading Regulations

Regulations can vary widely from one country to another. For example, while the FCA in the UK has stringent requirements to ensure consumer protection, other regions may have more relaxed regulations. This disparity can lead to a regulatory “race to the bottom,” where brokers move operations to jurisdictions with less oversight to offer more attractive trading conditions.

Challenges and Criticisms of Forex Regulations

Despite their importance, forex regulations are not without challenges and criticisms. Some of these include:

- Bureaucracy: The regulatory process can be slow and cumbersome, sometimes hindering innovation and market growth.

- Inconsistency: Differing regulations across jurisdictions can create confusion for traders and brokers operating internationally.

- Compliance Costs: The cost of compliance with regulations can be high, especially for smaller brokers, which may limit competition and lead to increased trading costs for clients.

Navigating Forex Regulations as a Trader

For traders looking to navigate the forex regulatory landscape, several steps can help ensure a safe trading experience:

- Research the Broker: Before opening an account, research the broker’s regulatory status. Look for information on their licenses, customer reviews, and any disciplinary history.

- Understand the Regulatory Environment: Familiarize yourself with the regulations in your jurisdiction and those applicable to the broker’s location.

- Stay Informed: Regulations can evolve, so it’s crucial to stay updated on any changes that may impact your trading.

The Future of Forex Trading Regulations

The forex trading landscape is continually evolving, and so are the regulations governing it. As technology advances, regulators are exploring new ways to address emerging issues, such as digital currencies and fintech innovations. The future may see more harmonized global regulations that provide clarity and protection for traders, regardless of where they operate.

Conclusion

Forex trading regulations are essential for ensuring a fair and transparent trading environment. While they may pose challenges, they ultimately serve to protect traders and promote market integrity. As the forex market continues to grow and evolve, staying informed about regulations will be crucial for traders seeking to succeed in this dynamic environment.